A Kansas City firm plans to begin construction on a new 600-acre industrial park in Pontoon Beach, the latest indication that a hot market for new warehouse space isnÔÇÖt cooling down here yet.

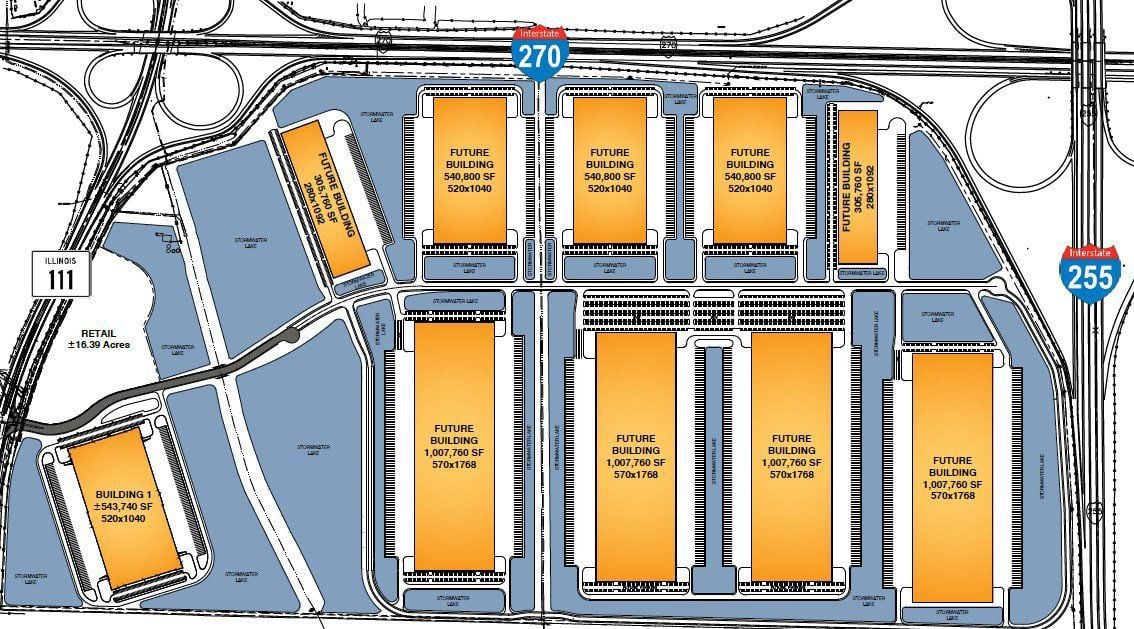

The new park in the Metro East, planned by NorthPoint Development along the south side of Interstates 270 between Interstate 255 and Illinois Route 111, could add as much as 7 million square feet of logistics space to the market even as NorthPoint and other companies continue to build huge new warehouses elsewhere.

NorthPoint Development closed on the purchase of the real estate last week, buying it from Landmark Development LLC, a company registered to Michele Kahni of trucking company Dynamic Transit in Granite City. Pontoon Beach documents indicate NorthPoint planned to pay $19.5 million for acquisition of the real estate.

Gateway TradePort will be the fourth major logistics park in the ├█Ð┐┤½├¢ area for NorthPoint. The firm has rapidly expanded in the ├█Ð┐┤½├¢ area since 2015, when it bought the stalled Hazelwood Logistics Center and announced plans for a 1.13 million-square-foot warehouse to serve GMÔÇÖs Wentzville assembly plant.

People are also reading…

ÔÇ£This park will complement our offerings on the Missouri side using our formula for success: great location, continuous spec program with flexible building layouts, along with market leading tax abatement for bulk users in the Metro East submarket,ÔÇØ NorthPointÔÇÖs vice president of development Johan Henriksen said in a statement.

NorthPoint plans to begin building a 540,000-square-foot speculative warehouse at the end of the first quarter, with construction expected to be complete by the end of the year. In all, the site could eventually house 10 warehouses totaling 7 million square feet of space. Plans also show 16 acres of land would be used for retail development along Illinois Route 111.

The new park is right across Interstate 270 from two other big industrial parks, Gateway Commerce Center and Lakeview Commerce Center, that have had several large new buildings added in recent years as companies seek large, modern warehouse space to accommodate consumers who increasingly shop online.

├█Ð┐┤½├¢, like other markets, is responding to the demand for space to store and ship finished goods as e-commerce continues growing.┬á

ÔÇ£ThatÔÇÖs allowed the industrial warehouse segment to really have the wind at their back,ÔÇØ Henriksen said in an interview.

Pontoon Beach approved this month a tax increment financing (TIF) district to defray over 20 years up to $116.3 million in development costs, including new utilities, professional services and site preparation, according to the development plan. TIF allows increases in property taxes from development to be used to repay some of those development costs.

The TIF will give NorthPoint ÔÇ£the most competitiveÔÇØ incentive program in the Metro East, Henriksen said.

At the Gateway and Lakeview Commerce Centers to the north, for example, an Enterprise Zone offers only seven years of full property tax abatement, with the amount decreasing after that until the incentive goes away after the 10th year.

ÔÇÿCompetitive businessÔÇÖ

Last year, Maryland Heights-based World Wide Technology announced plans to move from Lakeview Commerce Center into 2 million square feet of new space being developed by TriStar Properties in the Gateway Commerce Center. Duke Realty, an owner in the Lakeview Center, tried to keep World Wide but couldnÔÇÖt compete with the lease rates offered at Gateway because the tax incentives were expiring on DukeÔÇÖs properties.

Meanwhile, two warehouses opened in those parks last year, pushing the Metro EastÔÇÖs industrial vacancy rate to 7.4 percent at the end of 2018, higher than other submarkets and above the regionÔÇÖs overall industrial vacancy rate of 5.6 percent, according to research from Cushman & Wakefield.

├█Ð┐┤½├¢ County Port Authority signs off on state economic development incentive.┬á

Another developer, Exeter, has started the first of two Gateway Commerce buildings after purchasing part of the park for $10.6 million last year, according to Cushman and Wakefield. When the two buildings are completed, it will add another 1.7 million square feet to the park.

Even with all the construction, lease rates in the region rose to $4.88 per square foot at the end of last year, up from $4.47 a year prior, according to CushmanÔÇÖs research. In Metro EastÔÇÖs two big logistics parks, lease rates ranged from $3.75 to $4.95 per square foot.

NorthPointÔÇÖs Henriksen said that the industrial real estate space right now was ÔÇ£a competitive businessÔÇØ but that ÔÇ£thereÔÇÖs a lot of activity, especially on the smaller tenant sizes.ÔÇØ

Tech giant signs lease for 2 million-square-feet of industrial space at the Gateway Commerce Center in Edwardsville, plans to add 500 jobs.

David Branding of commercial real estate firm JLL will market NorthPointÔÇÖs new Gateway TradePort. Henriksen said lease rates could be about $3.75 per square foot.

NorthPointÔÇÖs TradePort will be the companyÔÇÖs first Metro East logistics park. The Hazelwood Logistics Park is already fully leased, and NorthPoint just finished its first two buildings in the Hazelwood TradePort industrial park being developed near the ├█Ð┐┤½├¢ Outlet Mall.

One 275,000-square-foot building completed at the end of last year is about 75 percent leased, and the other, a 495,000-square-foot building completed last month, is about 25 percent leased, Henriksen said. Another six buildings could be developed in the area around the old Mills Mall.

Jamestown Mall redevelopment?

The Metro East isnÔÇÖt the only new project NorthPoint is eyeing. ItÔÇÖs still interested in redeveloping the Jamestown Mall site that ├█Ð┐┤½├¢ CountyÔÇÖs economic development arms have acquired in recent years.

├█Ð┐┤½├¢ County officials said in May that NorthPoint planned to acquire the dead mall from the ├█Ð┐┤½├¢ County Port Authority for $2.5 million and abate any hazardous waste and demolish the mall at its own expense.

However, the property has yet to change hands. The Port Authority is also in legal limbo, with the ├█Ð┐┤½├¢ County Council and ├█Ð┐┤½├¢ County Executive Steve Stenger fighting in court over which branch of government controls the powerful economic development body.

Henriksen said Tuesday that NorthPoint was still interested in Jamestown Mall but that it had to wait until after the August primary election because members of the county council ÔÇö who have long been at odds with Stenger ÔÇö were hesitant to participate in the project.

NorthPoint Logistics, which also has several warehouses in Hazelwood, was the only bidder for the project

ÔÇ£We would like to move forward, but we have been sitting, waiting to find out what the county is doing,ÔÇØ Henriksen said.

He said he planned to meet with Councilwoman Rochelle Walton Gray, who represents the area, soon to ÔÇ£see if we can get a project that can work.ÔÇØ

It will be expensive to demolish the mall, Henriksen said, and it is situated in an ÔÇ£unproven locationÔÇØ for logistics parks. But he said NorthPoint was still interested if the county is.

ÔÇ£It could be a really nice opportunity for a job-creation project,ÔÇØ Henriksen said.

Walton Gray had initially said she wasnÔÇÖt happy with the plan for warehouse space, but she said Tuesday she was meeting with NorthPoint soon and was ÔÇ£open to a compromiseÔÇØ that wouldnÔÇÖt be entirely a warehouse development.

Rodney Crim, the interim CEO of the ├█Ð┐┤½├¢ Economic Development Partnership, said Tuesday that he and his staff were examining the status of the Jamestown Mall deal and ÔÇ£trying to understand what that situation was.ÔÇØ