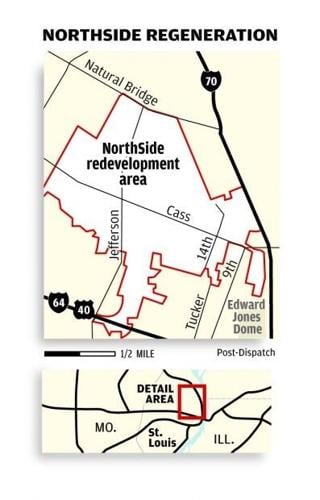

A ├█č┐┤½├Į economic development board balked Tuesday at a request for more tax credits for a proposed $19.6 million gas station and grocery store north of downtown ŌĆö the first significant project within Paul McKeeŌĆÖs long-stalled NorthSide Regeneration plan.

Questions about the total cost and development fees prompted the ├█č┐┤½├Į Development Corporation board to table a proposal from ├█č┐┤½├Į Grocery Group LLC seeking another $3 million in New Markets Tax Credits .

, the questions signaled growing skepticism at the mounting tally of subsidies and the complex financing structure needed to build the grocery store and gas station near the Stan Musial Veterans Memorial Bridge. The city hopes to jump-start development in the low-income area as it prepares a huge nearby site for the National Geospatial-Intelligence Agency and the spy agencyŌĆÖs 3,100 employees.

People are also reading…

The development board, which controls the cityŌĆÖs allocation of the federal tax credits, had toward the project in August.

This time, the board questioned the nearly $20 million cost to construct a 20,000-square-foot grocery branded as the GreenLeaf Community Marketplace and a 6,500-square-foot Zoom gas station and convenience store near the intersection of Tucker Boulevard and Cass Avenue.

ŌĆ£ThatŌĆÖs north of $500 a square foot,ŌĆØ Alderman Stephen Conway, an SLDC board member, told the development group. ŌĆ£Why is the construction cost so high?ŌĆØ

Minerva Realty Capital Managing Director Russell Caplin, representing the development group, said the total cost includes infrastructure improvements and ŌĆ£significantŌĆØ roadway improvements. It also includes $1.9 million in initial inventory costs for the stores.

The group needs New Markets because the lender, Cedar Rapids Bank & Trust of Iowa, wanted an extra reserve fund in order to make a $10 million loan for the project, Caplin said. ŌĆ£It would be very difficult for us to move forward without it,ŌĆØ Caplin said of the additional New Markets credits.

The extra $3 million in New Markets Tax Credits would come from a $5 million allocation the city granted to a small hospital McKee planned within the 1,500-acre NorthSide footprint.

The city would no longer commit those credits to the hospital project and use $2 million of that commitment elsewhere.

Darryl Piggee, an attorney for McKee, said the hospital project is still advancing and can use other tax credits if the city opts to withdraw its New Markets commitment to the medical center.

TIF and equity

Last year, the ├█č┐┤½├Į Board of Aldermen approved for the project. It would be the first assistance from a much larger TIF district established for McKeeŌĆÖs NorthSide plans in 2009.

Under questioning from commissioners, Caplin said the developers would replace the only owner equity going into the project using funds raised from TIF notes.

ŌĆ£So the owner will have no equity when that occurs?ŌĆØ SLDC board member Wendy Timm said.

Timm said the ŌĆ£lack of permanenceŌĆØ of developer equity gave her pause. She also wanted more details on over $1 million in management fees as well as provisions making the fees ŌĆ£more contingent on delivering.ŌĆØ

Chris Goodson, another board member, said he wanted to support the project because it would provide ŌĆ£food service in a food desert,ŌĆØ but that he had questions about the total cost.

ŌĆ£IŌĆÖm just having a hard time with that north-of-$500-per-square-foot project cost,ŌĆØ he said.

Asked whether the project could accommodate the boardŌĆÖs requests, Caplin said: ŌĆ£WeŌĆÖll need to have further discussions, but we look forward to working with the board on a solution.ŌĆØ

NorthSide fees

SLDC chief Otis Williams emphasized that the agreement bars proceeds from the additional New Markets credits from being distributed as fees to NorthSide Regeneration LLC, the main entity McKee has used to acquire hundreds of acres north of downtown.

However, the larger deal anticipates spending $3.4 million to acquire property for the development, much of which is owned by NorthSide Regeneration and another company, 1312 LLC. That companyŌĆÖs registered agent, Fred Lafser, has worked with McKee on NorthSide.

Piggee said the land price is due to a property lien from Bank of Washington, . ŌĆ£ThatŌĆÖs the release price from the lender,ŌĆØ he said.

In an initial report from SLDC, the city listed Rodney Hubbard as one of the owners of ├█č┐┤½├Į Grocery Group LLC. McKee attorney Steve Stone said that referred to Rodney Hubbard Jr., a member of , but that HubbardŌĆÖs interest had been bought out and the SLDC report was ŌĆ£a misprint.ŌĆØ

Alderman Tammika Hubbard, Hubbard Jr.ŌĆÖs sister, had sponsored the bill to allow TIF funding for the project last year. Stone said Hubbard Jr. was ŌĆ£long gone before any ordinancesŌĆØ were introduced.

Williams said the final report removed the reference to the ownership group after McKeeŌĆÖs lawyers informed him Monday that Hubbard Jr.ŌĆÖs interest had been purchased. Williams said he didnŌĆÖt know when Hubbard Jr. had been bought out.

Tammika Hubbard did not respond to a message left at a phone number listed for her Tuesday.

If the tax credits ultimately go through, construction could start about 45 days after that, Caplin said.